From $815K to $1.05M in Under 2 Years – Georgetown Growth Play

Jen, a Sydney investor with Newcastle ties, acquired an R3-zoned off-market terrace for $815K. With JORIS Advisory’s rapid site strategy, firm negotiation and rental-focused Upside Advisory renovation, its value soared to $1.05M in less than two years, her top-performing asset, proof of decisive action and local expertise.

Project Snapshot

Quick Snapshot

A seasoned Sydney-based investor with family ties to Newcastle, wasn’t actively in the market. But when we uncovered a high-potential, off-market home in her backyard, she jumped. With R3 zoning, strong bones, and serious value-add potential, she secured it for $815K. Less than two years later, it’s worth $1.05M, her top-performing asset, made possible by smart timing, firm negotiation, and our Upside Advisory strategy.

Meet the Client

The Challenge

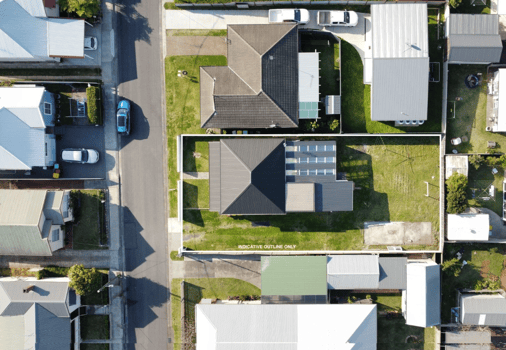

Before & After Gallery

What We Did

Site Visit & Strategy Session: After identifying the opportunity, we conducted an immediate site visit. Given our proximity (one street away), we assessed zoning potential, capital growth outlook, and value-add options on the ground.

Sharp Negotiation: Jen was ready to offer an extra $20K to lock it in. We advised her to hold firm, securing the property for $815,000 and keeping funds available for a renovation.

Purchase Coordination: We moved quickly, having deal history from off-market to on-market and kept wider competition in check with better conditions and the strongest offer (at the same price point). Jen trusted the advice and moved decisively.

Renovation Planning & Advisory: Post-settlement, Jen followed our Upside Advisory advice to complete a light structural, rental-focused renovation, designed to lift valuation and yield without overcapitalising.

The Result

Less than two years on, the property is valued (Bank) at around $1.05M, an uplift of $235,000 on paper, before accounting for rental income or additional renovation upside.

It’s Jen’s highest-performing investment so far. More importantly, she now owns a future-proof property in a tightly held pocket, primed for long-term gains, and acquired through decisive action, local insight, and a clear renovation plan.

Looking for strategic opportunities without wasting time? Let’s talk.

Project Gallery

"I wasn’t actively looking for a place yet Joris came across an off market opportunity that then went live. With his experience and negotiation skills within 10days it was all done & dusted and even stopped me from offering more money. Fast forward a small Reno, its now rented & produced 6 figure equity. Don’t walk, run! / mix To say I am thrilled with how Joris helped me find my new investment home would be an understatement!"

J., 2025